BAE Systems, Britain’s largest weapons manufacturer, has agreed a £4.4 billion deal to buy US space technology company Ball Aerospace.

BAE said that the deal, one of the largest by a UK firm in 2023 to date, would strengthen its multi-domain portfolio including strong growth potential in areas aligned with the US Intelligence Community and Department of Defense’s highest priorities; attractive positioning and outlook across military and civil space, C4ISR and missile and munition markets; and substantial increase to its US classified revenues, offerings and embedded customer relationships.

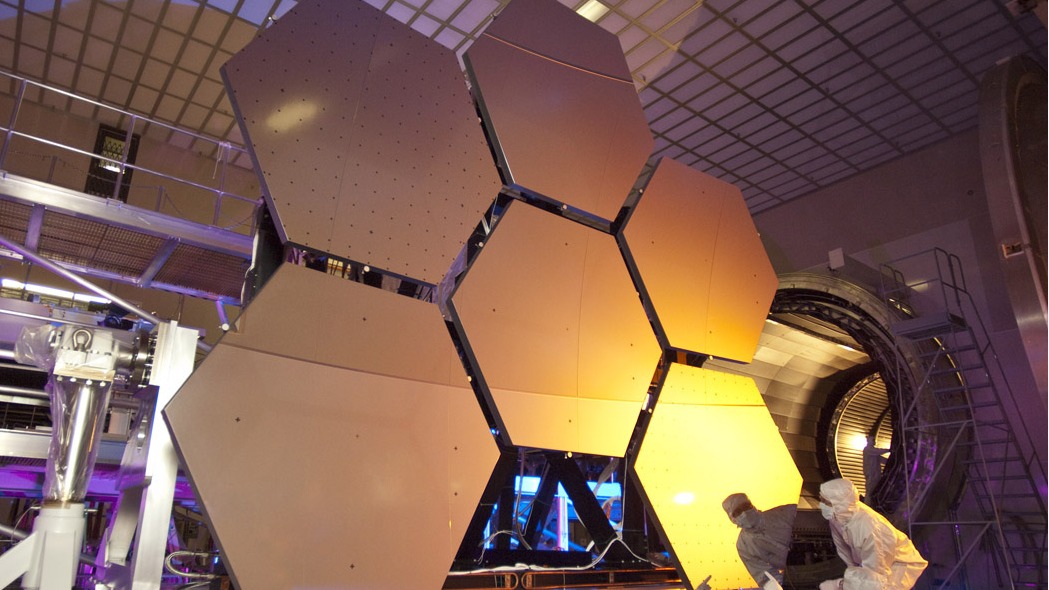

Colorado-based Ball Aerospace was put up for sale in June 2022. The company is described as a leading provider of spacecraft, mission payloads, optical systems, and antenna systems. It has strong relationships with the US Department of Defense along with civilian space agencies and the Intelligence Community.

The company's biggest growth area is its high-margin military technologies, such as its laser communication systems that link infantry and drones.

The deal is subject to customary regulatory approvals and conditions with a targeted completion date in the first half of 2024. It contains a $100 million termination fee payable by BAE Systems to Ball Aerospace in the event that the deal does not go through.

Commenting on the announcement, Charles Woodburn, chief executive of BAE Systems, said: “The proposed acquisition of Ball Aerospace is a unique opportunity to add a high quality, fast growing technology focused business with significant capabilities to our core business that is performing strongly and well positioned for sustained growth. It’s rare that a business of this quality, scale and complementary capabilities, with strong growth prospects and a close fit to our strategy, becomes available.

“The strategic and financial rationale is compelling, as we continue to focus on areas of high priority defence and Intelligence spending, strengthening our world class multi-domain portfolio and enhancing our value compounding model of top line growth, margin expansion and high cash generation.”

Latest News

-

Lloyds Banking Group doubles AI value target to £100m in 2026

-

Tesla to end Model S and Model X production as Musk shifts focus to robotics

-

ASA bans Coinbase adverts ‘trivialising risks’ of cryptocurrency

-

Gumtree rolls out Know Your Business technology

-

Government announces free AI training to upskill 10m people

-

OpenAI to launch SME accelerator as part of new EU scheme

The future-ready CFO: Driving strategic growth and innovation

This National Technology News webinar sponsored by Sage will explore how CFOs can leverage their unique blend of financial acumen, technological savvy, and strategic mindset to foster cross-functional collaboration and shape overall company direction. Attendees will gain insights into breaking down operational silos, aligning goals across departments like IT, operations, HR, and marketing, and utilising technology to enable real-time data sharing and visibility.

The corporate roadmap to payment excellence: Keeping pace with emerging trends to maximise growth opportunities

In today's rapidly evolving finance and accounting landscape, one of the biggest challenges organisations face is attracting and retaining top talent. As automation and AI revolutionise the profession, finance teams require new skillsets centred on analysis, collaboration, and strategic thinking to drive sustainable competitive advantage.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories