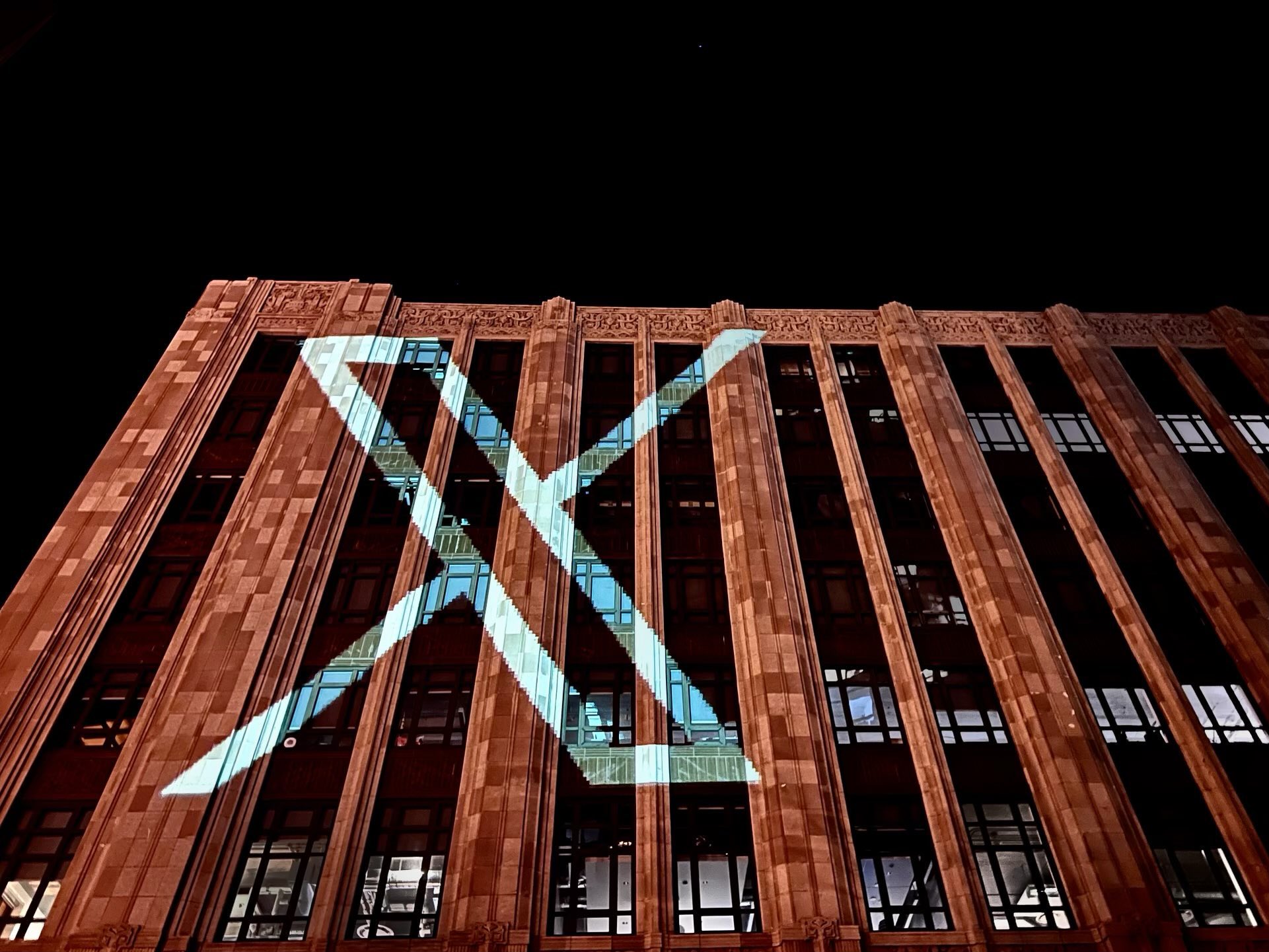

Elon Musk’s X, formerly known as Twitter, has suffered further ignominy after investment giant Fidelity has once again downgraded its valuation of the social media platform.

According to a new securities filing, Fidelity believes the shares it holds of X are now worth 71.5 per cent less than when Musk completed his $44 billion takeover in October 2022.

The filing from the Blue Chip Growth Fund, which is worth more than $49 billion, was dated 30 December and reported information through 30 November. The shares in X, which represent less than .01 per cent of the fund’s total value, are worth less than $5.6 million – a significant decrease from the $19.66 million it was worth around the time of Musk’s takeover.

Fidelity has consistently cut the estimated value of its X shares, which were worth $6.55 million in April 2023.

X was taken private by Musk following his acquisition, leading Fidelity’s estimates to become a closely watched indicator of the company’s health and investor attitudes towards the controversial owner.

Based on Fidelity’s estimates, X is now worth around $12.5 billion.

Latest News

-

UK confirms October hack on Foreign Office systems as investigation continues

-

Deichmann launches new order fulfilment system

-

SoFi unveils 'first US' bank‑issued stablecoin

-

UK government to ban ‘nudification’ tools

-

Bank of England governor says AI will ‘displace jobs’

-

PornHub probes reported breach affecting premium users’ viewing data

The future-ready CFO: Driving strategic growth and innovation

This National Technology News webinar sponsored by Sage will explore how CFOs can leverage their unique blend of financial acumen, technological savvy, and strategic mindset to foster cross-functional collaboration and shape overall company direction. Attendees will gain insights into breaking down operational silos, aligning goals across departments like IT, operations, HR, and marketing, and utilising technology to enable real-time data sharing and visibility.

The corporate roadmap to payment excellence: Keeping pace with emerging trends to maximise growth opportunities

In today's rapidly evolving finance and accounting landscape, one of the biggest challenges organisations face is attracting and retaining top talent. As automation and AI revolutionise the profession, finance teams require new skillsets centred on analysis, collaboration, and strategic thinking to drive sustainable competitive advantage.

© 2019 Perspective Publishing Privacy & Cookies

.jpg)

Recent Stories