Lloyds Bank has launched a new Open Banking feature that enables its customers to request money from friends and family on its mobile banking app.

Link Pay enables users to request money back for shared purchases like restaurant bills or joint presents.

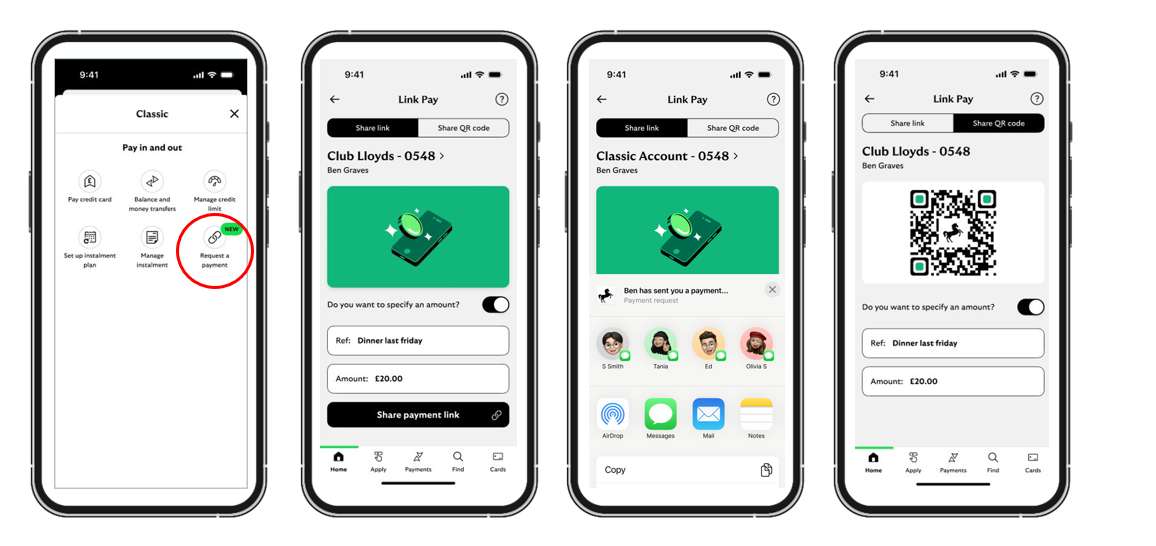

Lloyds customers can now send a request with a unique link or show a QR code, which means they don't need to share personal account details.

The link pre-populates all the information needed, using Open Banking to take the sender straight to their own banking app to make the payment without asking for any other details.

The request, which can be sent via WhatsApp, SMS or Facebook Messenger, is then sent straight to the person who owes money.

The new feature lets customers personalise the request with an amount and a reference, which removes the need to set up a new payee.

Customers can request up to £150 each time and receive a maximum of £500 per day.

“We want our customers to have simple, secure ways to move money at their fingertips and our new Link Pay feature in our app helps them do just that," said Gabby Collins, payments director at Lloyds. "No need to dig out a sort code and account number when someone owes you money – just add the amount and what the payment is for, and we’ll handle the rest.

"It’s never been simpler to get your sibling to repay you for Dad’s birthday gift.”

Latest News

-

Indra wins TfL contract to run London ticketing systems

-

Japan ‘launches government probe’ into Grok

-

Social media sites stop access to 4.7m under-16 accounts in Australia

-

Government announces £52m funding to support British robotics and defence tech firms

-

Swift to launch blockchain-based shared ledger after successful digital asset pilot

-

AWS launches European sovereign cloud service

The future-ready CFO: Driving strategic growth and innovation

This National Technology News webinar sponsored by Sage will explore how CFOs can leverage their unique blend of financial acumen, technological savvy, and strategic mindset to foster cross-functional collaboration and shape overall company direction. Attendees will gain insights into breaking down operational silos, aligning goals across departments like IT, operations, HR, and marketing, and utilising technology to enable real-time data sharing and visibility.

The corporate roadmap to payment excellence: Keeping pace with emerging trends to maximise growth opportunities

In today's rapidly evolving finance and accounting landscape, one of the biggest challenges organisations face is attracting and retaining top talent. As automation and AI revolutionise the profession, finance teams require new skillsets centred on analysis, collaboration, and strategic thinking to drive sustainable competitive advantage.

© 2019 Perspective Publishing Privacy & Cookies

.jpg)

Recent Stories