Klarna, the Swedish financial technology firm known for its buy now, pay later services, has announced the launch of two new banking products as it seeks to disrupt the retail banking sector.

The move comes as the company edges closer to a potential initial public offering (IPO) in the US.

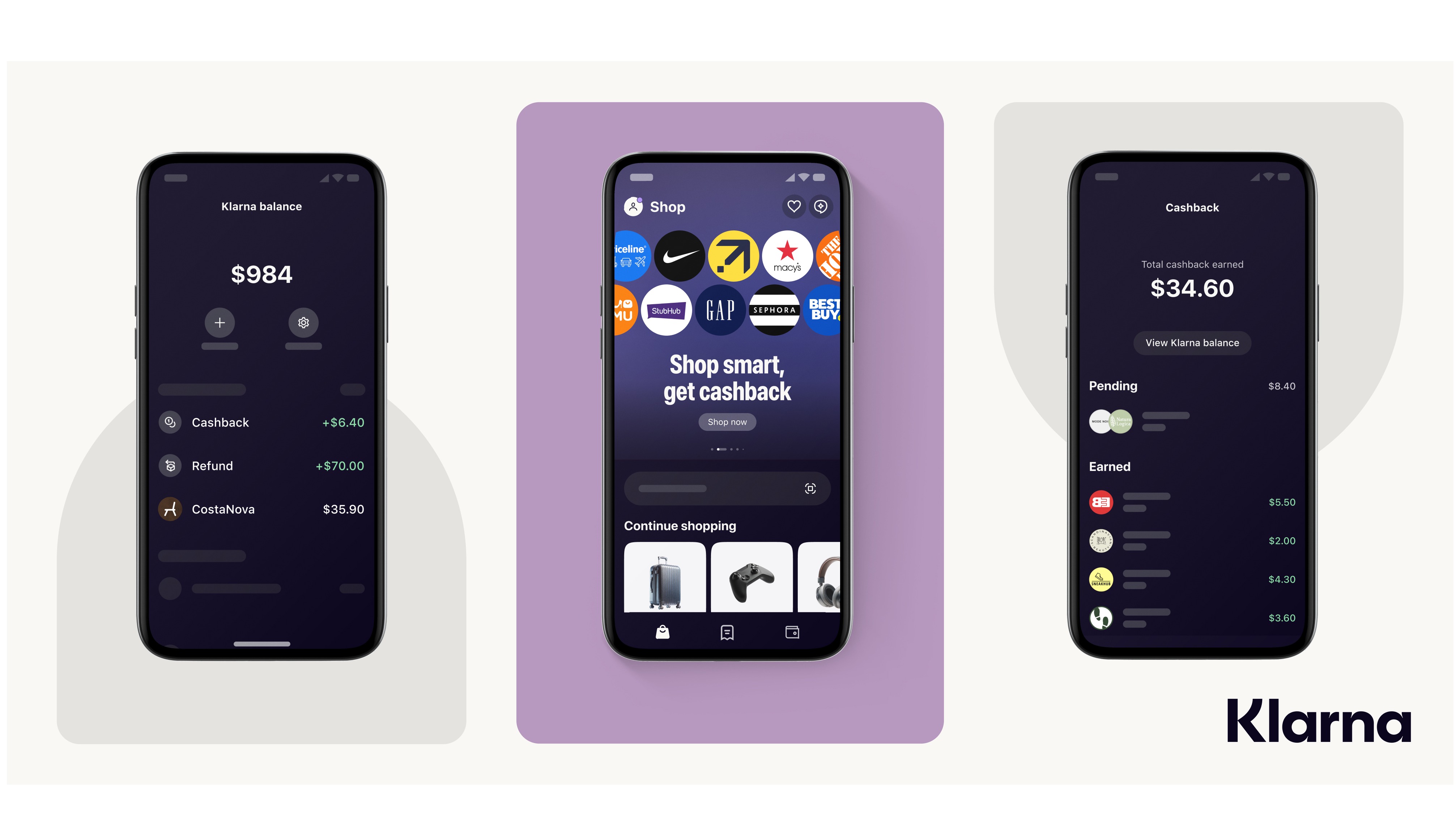

The new offerings, called "balance" and "cashback", are being rolled out across 12 markets including the US and several European countries. Klarna balance allows users to store money in a bank-like personal account, which can be used for instant purchases and to pay off buy now, pay later loans. Customers can also receive refunds for returned items directly into their balance account.

The cashback feature offers customers the opportunity to earn up to 10 per cent of the value of their purchases at participating retailers as rewards. Any money earned is automatically stored in the user's balance account.

Sebastian Siemiatkowski, Klarna's founder and chief executive officer, told CNBC: "These new products make it easier for customers to manage multiple scheduled payments, helping our customers use Klarna for more frequent purchases and driving loyalty."

In the European Union, where Klarna holds an official bank licence, customers will be able to earn up to 3.58 per cent interest on their deposits. However, US customers will not have access to this interest-earning feature.

The launch marks a significant expansion of Klarna's product range as it prepares for a much-anticipated IPO. While no fixed timeline has been set, Siemiatkowski stated in a February interview that a public listing this year was "not impossible".

Reports suggest Klarna is aiming for a valuation of around $20 billion when it goes public. The company is reportedly in talks with Goldman Sachs to lead the IPO process, though spokespersons for both firms declined to comment on these reports.

Latest News

-

Meta and Nvidia sign multiyear chip deal worth tens of billions of dollars

-

Amazon to open zero carbon delivery station in Stockton-on-Tees

-

EU launches formal Shein probe over illegal products and 'addictive' design

-

DBS Bank trials Visa's agentic commerce tools in Asia Pacific first

-

Government campaign urges SMEs to 'lock the door' on cyber criminals

-

Unilever partners with Google Cloud to support business transformation

The future-ready CFO: Driving strategic growth and innovation

This National Technology News webinar sponsored by Sage will explore how CFOs can leverage their unique blend of financial acumen, technological savvy, and strategic mindset to foster cross-functional collaboration and shape overall company direction. Attendees will gain insights into breaking down operational silos, aligning goals across departments like IT, operations, HR, and marketing, and utilising technology to enable real-time data sharing and visibility.

The corporate roadmap to payment excellence: Keeping pace with emerging trends to maximise growth opportunities

In today's rapidly evolving finance and accounting landscape, one of the biggest challenges organisations face is attracting and retaining top talent. As automation and AI revolutionise the profession, finance teams require new skillsets centred on analysis, collaboration, and strategic thinking to drive sustainable competitive advantage.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories